Table of Contents

ChatGPT paying users could hit 220 million by 2030, according to internal projections OpenAI recently shared with investors. If the forecast holds, it would transform the AI assistant from a curiosity into one of the world’s largest subscription businesses, right alongside Spotify and Netflix. The company expects roughly 8.5% of an estimated 2.6 billion weekly users to convert into paying customers through subscriptions, enterprise contracts, and API access over the next five years.

That’s the bullish case, anyway. And it positions artificial intelligence not as some abstract technological force, but as infrastructure, as essential to modern business operations as cloud computing or email. The forecast landed this week via The Information, and while OpenAI declined to comment, the numbers tell a story about where the company thinks this industry is headed.

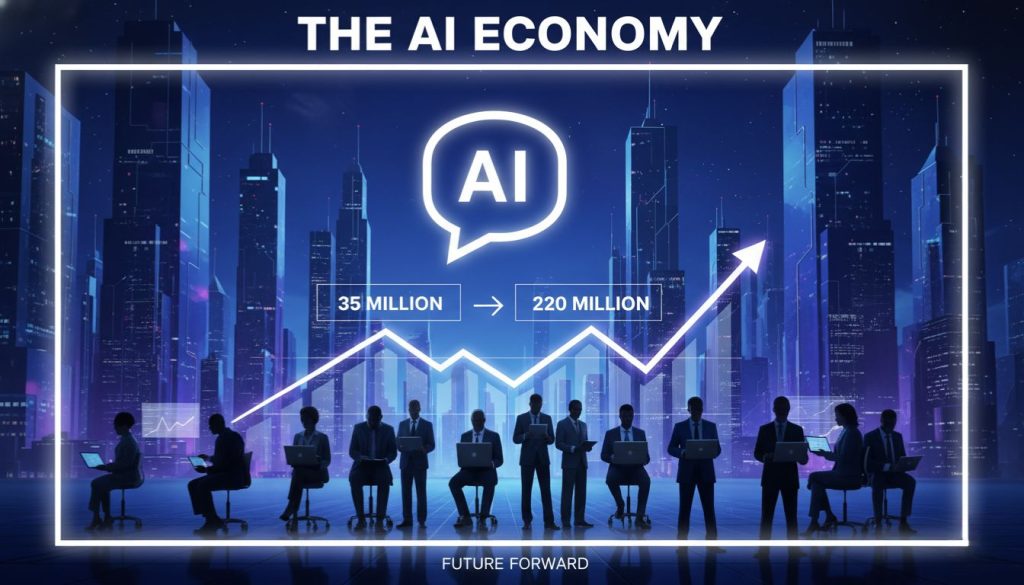

ChatGPT Paying Users: From 35 Million to 220 Million

Today, about 35 million people pay for ChatGPT Plus or Pro plans, priced at $20 and $200 per month respectively. That’s roughly 5% of the weekly active user base as of mid-2025. OpenAI is betting it can nearly double that conversion rate to 8.5% while simultaneously growing total users from around 800 million today to 2.6 billion by decade’s end.

The math is aggressive but not outlandish. Consider that Spotify took 15 years to reach 220 million paid subscribers. OpenAI thinks it can get there in about seven, starting from a base of millions who already use the free tier daily. The difference? ChatGPT isn’t competing with radio or piracy. It’s competing with how work gets done.

And that’s where the enterprise angle comes in. OpenAI isn’t just counting on individual hobbyists upgrading to Plus. The real revenue driver is companies, law firms, marketing agencies, and Fortune 500 departments embedding GPT-4 into daily workflows. Organizations already signing contracts worth over $10 million annually, according to industry reports. Some are deploying custom models across thousands of employees, all paying per seat or per API call.

The Enterprise Bet: AI as Core Infrastructure

What OpenAI is really projecting here isn’t consumer adoption. It’s the industrialization of conversational AI. The company’s following a playbook perfected by Zoom and Slack: hook users on the free product, then go after their employers with premium plans that promise security, compliance, and team collaboration.

By mid-2025, OpenAI already had over 3 million paying business users. If the 220 million target is even remotely accurate, a significant chunk will come from enterprise deals where entire departments or companies subscribe en masse. Think of it less like Netflix and more like Salesforce or Microsoft 365, where software spend becomes a line item in every corporate budget.

That shift has implications. For one, it pressures traditional SaaS companies to integrate AI faster or risk becoming obsolete. Why pay for separate tools when ChatGPT can draft emails, analyze spreadsheets, and generate presentations? OpenAI’s recent addition of productivity features, letting users edit documents and create slides inside the chatbot, is a direct challenge to Microsoft and Google’s productivity suites (as OpenAI expands its ambitions beyond chatbot services).

It also creates opportunities. Developers building on OpenAI’s APIs could see demand explode as more companies commit to AI-first strategies. The company’s API business already contributes 15-20% of revenue, and that percentage could grow as third-party platforms embed GPT functionality into everything from customer service bots to financial analysis tools.

The Revenue Reality: Growth Amid Mounting Losses

Here’s the uncomfortable truth tucked inside these rosy projections: OpenAI is burning through cash. The company’s on track to lose around $8 billion in 2025, even as annualized revenue hits $20 billion by year-end. That’s because training and running these models is obscenely expensive. Compute costs alone consume a massive portion of revenue, and the company has admitted it’s constantly constrained by hardware availability, forcing it to delay product rollouts when GPU supplies run short.

The 220 million paying users forecast is OpenAI’s answer to that problem. More subscribers mean more predictable recurring revenue, which in turn justifies the billions being spent on infrastructure. But the path from here to there is fraught. Competitors like Anthropic, which has reached a $9 billion revenue run rate by focusing heavily on enterprise customers, and Google with its Gemini models, aren’t standing still. Regulatory scrutiny is mounting globally, particularly around data privacy and AI safety.

The infrastructure challenges aren’t hypothetical. In late February 2025, OpenAI CEO Sam Altman acknowledged the company had “run out of GPUs” while attempting to roll out its GPT-4.5 model. The company needed tens of thousands of additional graphics processing units just to support broader access to a single new model. Altman described it as expensive and resource-intensive, requiring a phased rollout that prioritized $200-per-month Pro subscribers over the larger Plus user base.

This shortage reveals the Catch-22 at the heart of OpenAI’s growth projections. To attract 220 million ChatGPT paying users, the company needs better, faster, more capable models. But building and running those models requires compute infrastructure that’s already stretched to its limits. The costs are staggering: training runs alone can consume billions of dollars in GPU time, and inference at scale adds recurring costs that grow with every new subscriber.

OpenAI’s solution involves vertical integration. The company is reportedly working with Broadcom on custom AI chips, aiming to reduce its reliance on Nvidia and gain more control over its hardware roadmap. Mass production could begin as early as 2026, though that timeline is ambitious given the complexity of chip design and manufacturing. Meanwhile, OpenAI is also expanding its data center footprint, signing a $38 billion deal with Amazon Web Services for Nvidia-powered cloud compute capacity.

What This Means for the Software Industry

If OpenAI hits even 70% of this target, it fundamentally reshapes enterprise software spending. AI budgets that didn’t exist three years ago will balloon into must-have line items. Companies will reallocate dollars away from legacy SaaS tools toward conversational AI platforms that promise to do more with fewer clicks.

For incumbent software giants, the message is clear: integrate or get disrupted. Microsoft, which has invested $13 billion in OpenAI and embedded GPT across Azure and Office, is betting heavily on this future. Others will need to move fast or risk becoming the next generation’s legacy system.

The forecast also signals a broader shift in how we think about AI adoption. This isn’t about early adopters anymore. OpenAI is projecting mass-market penetration, a future where paying for an AI assistant is as common as paying for cloud storage or streaming video. Whether that future arrives on schedule depends on execution, competition, and whether enterprises actually see enough value to justify the spend.

But the ambition is undeniable. OpenAI isn’t just building a chatbot. It’s building a platform, an ecosystem, and betting that by 2030, hundreds of millions of people and businesses will pay to be part of it.