Table of Contents

Warner Bros Discovery sale talks just exploded into the open, and Hollywood’s most dramatic corporate poker game has officially begun. The entertainment conglomerate announced Tuesday it’s exploring a full Warner Bros Discovery sale after receiving unsolicited acquisition interest, abandoning its planned corporate split and potentially triggering the media industry’s most consequential bidding war in a decade.

This Warner Bros Discovery sale opportunity isn’t just another routine corporate transaction. We’re talking about auctioning off HBO, CNN, DC Comics, the Harry Potter franchise, and a century’s worth of Warner Bros content—the kind of intellectual property empire that can’t be replicated at any price. The timing reveals everything you need to know about traditional media’s existential crisis: when a $40 billion company hangs a “for sale” sign this quickly after a major merger, panic has replaced strategy.

The Warner Bros Discovery Sale Started With Paramount’s Lowball Offer

The catalyst for this Warner Bros Discovery sale drama came from David Ellison’s Paramount Skydance, which approached the company in late September with an offer around $20 per share that was immediately rejected as insulting. Think of it as the corporate equivalent of offering $500,000 for a Manhattan penthouse—technically money, but not serious money.

Warner Bros Discovery sale prospects sent shares jumping approximately 9 percent Tuesday morning, reaching near $20, a market reaction suggesting Wall Street believes the company commands a significantly higher premium. Investors are essentially telling Paramount: bring real money or stop wasting everyone’s time.

What makes this Warner Bros Discovery sale situation particularly fascinating is the Ellison family’s voracious appetite for media dominance. Fresh off acquiring Paramount earlier this year in an $8 billion deal backed by Oracle co-founder Larry Ellison’s bottomless wallet, they’re already hunting their next trophy. It’s aggressive empire-building that raises serious questions about market concentration and whether we’re witnessing media monopoly formation that would make the old studio system look quaint.

Why the Warner Bros Discovery Sale Actually Matters

Let’s establish what’s on the auction block in this Warner Bros Discovery sale. This isn’t just another struggling media company. The conglomerate houses HBO, CNN, Max streaming platform, Warner Bros studios, and holds international sports broadcasting rights for everything from the Olympics to Premier League soccer. This represents the intellectual property equivalent of Fort Knox.

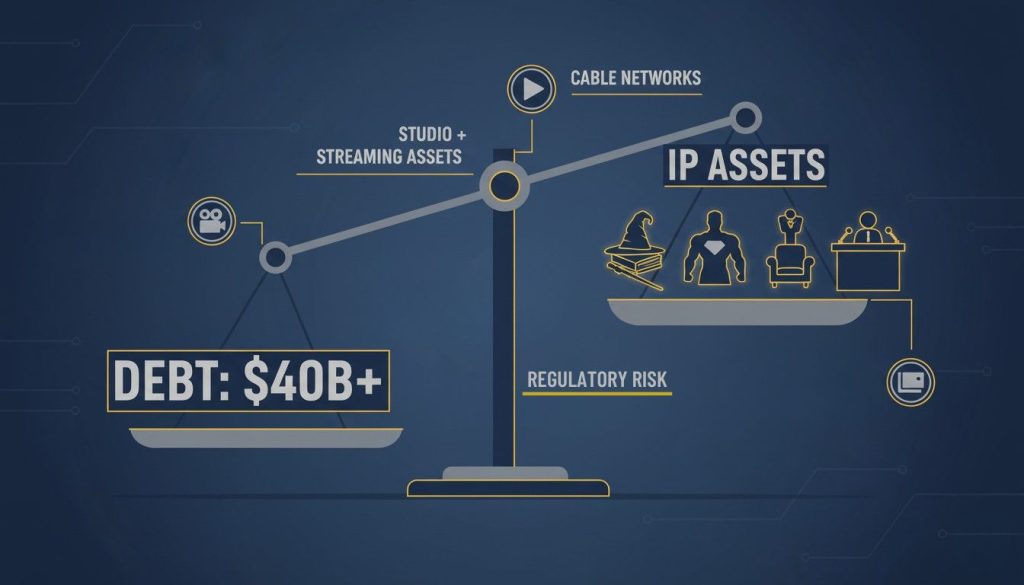

The Warner Bros Discovery sale includes franchises that generate billions: Harry Potter, Game of Thrones, DC superheroes (Superman, Batman, Wonder Woman), plus the entire Warner Bros film and television library stretching back nearly a century. For any tech company or competitor looking to instantly establish content credibility, this Warner Bros Discovery sale represents a shortcut impossible to replicate organically.

But here’s the complication making this Warner Bros Discovery sale challenging. The company faces mounting financial pressure since the 2022 merger of WarnerMedia and Discovery Inc., which loaded the balance sheet with more than $40 billion in debt. That debt load haunts every negotiating room, the reason why potential Warner Bros Discovery sale bidders need exceptionally deep pockets and high risk tolerance.

According to reporting by CNBC, the company’s original plan involved splitting into two entities by mid-2026: Warner Bros (streaming and studios) and Discovery Global (cable networks). The board announced it will evaluate strategic options including continuing the planned separation, a Warner Bros Discovery sale transaction for the entire company, or separate transactions for each business unit. Translation: everything is negotiable if the price is right.

Netflix Declines This Warner Bros Discovery Sale Opportunity

In a move surprising absolutely no one paying attention, Netflix co-CEO Ted Sarandos declared on the company’s third-quarter earnings call that “we have no interest in owning legacy media networks,” effectively removing Netflix from Warner Bros Discovery sale speculation. The streaming giant won’t be submitting any Warner Bros Discovery sale bids.

But read between the lines of Netflix’s Warner Bros Discovery sale position. Sarandos noted Netflix will continue evaluating opportunities but stay selective, weighing each potential deal against whether it enhances their entertainment portfolio or delivers more value than building capabilities internally. That’s corporate speak for “we’re builders, not buyers, unless the Warner Bros Discovery sale terms are absolutely perfect.”

The Netflix stance on this Warner Bros Discovery sale reveals something important about current media landscape dynamics. The streaming leader doesn’t need Warner Bros Discovery’s cable networks (CNN, TNT, Discovery Channel), which are bleeding subscribers and relevance. But the studio and streaming assets included in any Warner Bros Discovery sale? That’s a different conversation entirely. Netflix isn’t ruling out selective acquisitions; they’re just ruling out becoming another bloated conglomerate weighed down by linear television’s corpse.

The Real Players Circling This Warner Bros Discovery Sale

Netflix and Comcast are among interested parties in the Warner Bros Discovery sale discussions, according to sources, though seriousness levels remain unclear. Comcast presents an intriguing Warner Bros Discovery sale scenario. The NBCUniversal parent just announced plans spinning off most cable networks into a separate company called Versant, following Warner Bros Discovery’s original playbook. Why would they immediately pursue a Warner Bros Discovery sale of someone else’s cable network problems?

The answer in any Warner Bros Discovery sale might be studio and streaming assets. Comcast has the balance sheet absorbing Warner Bros Discovery’s debt, existing infrastructure integrating new content, and strategic motivation preventing competitors (Netflix, Amazon, Apple) from gaining overwhelming content advantages through this Warner Bros Discovery sale. But sources suggest Comcast doesn’t feel urgent pressure completing any Warner Bros Discovery sale deal—textbook negotiating leverage.

Then there’s the possibility of tech companies entering Warner Bros Discovery sale negotiations. Amazon already bought MGM. Apple has been tiptoeing around major content acquisitions. Could either make a Warner Bros Discovery sale play? The regulatory environment under current administration might be more permissive than previous years, potentially opening Warner Bros Discovery sale doors previously closed.

What This Warner Bros Discovery Sale Means for Democratic Media

Here’s where this Warner Bros Discovery sale story transcends mere business maneuvering and enters civic concern territory. Any Warner Bros Discovery sale includes CNN, one of America’s major news networks. Media analyst Mike Proulx warned that consolidation is “already trending towards a concerning level” and raises questions about content diversity and expression.

When just a handful of corporate giants control majority news outlets through deals like this Warner Bros Discovery sale, we’re not discussing business efficiency anymore. We’re discussing narrative power concentration in ways that should concern anyone valuing pluralistic democracy and diverse viewpoints.

The Ellison family’s political connections (Larry Ellison is a key ally of President Donald Trump) add complexity to any Warner Bros Discovery sale scenario. What happens when media ownership through Warner Bros Discovery sale transactions becomes increasingly intertwined with political power? The guardrails traditionally separating business interests from editorial independence grow thinner with each mega-merger.

This isn’t abstract theorizing about the Warner Bros Discovery sale implications. When AT&T owned Time Warner (which later became WarnerMedia), the Justice Department sued blocking the merger on antitrust grounds. That deal eventually proceeded, but concerns about market concentration were legitimate then and remain legitimate now considering this Warner Bros Discovery sale, perhaps even more so given subsequent consolidation waves.

How the Warner Bros Discovery Sale Reflects Streaming’s Endgame

This Warner Bros Discovery sale willingness represents a fundamental admission: the streaming wars have winners and losers, and being mid-tier isn’t financially sustainable. The Warner Bros Discovery sale option exists because HBO Max, despite quality content, hasn’t achieved Netflix’s global scale or Amazon’s vertical integration. Disney+ has the Mouse House’s century of content. What’s Warner Bros Discovery’s sustainable competitive advantage justifying independence over a Warner Bros Discovery sale?

The harsh reality making this Warner Bros Discovery sale inevitable is that streaming requires massive scale justifying content spending necessary retaining subscribers. Netflix co-CEO Greg Peters noted that previous mega-mergers like Disney-Fox, Amazon-MGM, and AT&T-Time Warner “were not a fundamental shift in the competitive landscape,” suggesting buying your way to streaming dominance through Warner Bros Discovery sale-type transactions doesn’t actually work.

But that hasn’t stopped companies from trying, making this Warner Bros Discovery sale attractive despite industry skepticism. The media industry seems trapped in consolidation cycles, each Warner Bros Discovery sale justified by “synergies” and “scale economies” that rarely materialize as advertised. Meanwhile, debt piles up, thousands of employees lose jobs through redundancy eliminations, and content libraries get homogenized as risk-averse executives greenlight increasingly similar projects.

The Warner Bros Discovery sale situation exemplifies these broader industry challenges. The 2022 merger creating the company was supposed to unlock value. Instead, it created a debt-laden entity now exploring a Warner Bros Discovery sale just three years later. That’s not strategic vision; that’s desperation dressed up in corporate communications language.

Where This Warner Bros Discovery Sale Goes From Here

Warner Bros Discovery said there’s no deadline or definitive timetable for completion of the strategic alternatives review process, meaning this Warner Bros Discovery sale could drag on for months. Expect leaks, counter-leaks, strategic positioning through friendly media outlets, and the full repertoire of M&A theater surrounding any Warner Bros Discovery sale negotiation.

The most likely Warner Bros Discovery sale outcome? A bidding war driving the price significantly higher than Paramount’s initial offer, potentially attracting players who weren’t initially interested but don’t want competitors acquiring such valuable assets cheaply. This Warner Bros Discovery sale dynamic is how Amazon ended up buying Whole Foods—companies get competitive when they see rivals circling valuable targets.

For media industry watchers and technology enthusiasts, this Warner Bros Discovery sale represents both past and future of entertainment. The studio system meeting streaming economics, legacy media wrestling with digital disruption, and corporate strategy colliding with market reality through this Warner Bros Discovery sale. The question isn’t whether consolidation will continue. The question is whether any Warner Bros Discovery sale will happen in ways serving anyone beyond shareholders and private equity investors.

As dust settles on this Warner Bros Discovery sale chapter of media consolidation, one thing becomes clear: the entertainment industry as we’ve known it is fundamentally restructuring. This Warner Bros Discovery sale opportunity isn’t an isolated incident. It’s a symptom of an entire industry trying to figure out what comes after cable television dies and before streaming economics actually make sense.

The Warner Bros Discovery sale bidding war has begun. Someone will eventually win this Warner Bros Discovery sale. But will audiences, employees, and democratic media institutions also win from any Warner Bros Discovery sale? That’s the billion-dollar question nobody’s asking loudly enough. Perhaps they should be learning from the transformative potential of AI in reshaping industries, which offers insights into how technological disruption fundamentally alters competitive landscapes, much like what’s happening in media today through this Warner Bros Discovery sale process.

Warner Bros Discovery Sale Timeline: The company did not set a completion timeline for its strategic review, meaning Warner Bros Discovery sale negotiations could extend well into 2026 as potential buyers conduct due diligence and financing arrangements for this unprecedented Warner Bros Discovery sale opportunity.